How Banks and Retailers are Testing Biometric Commerce

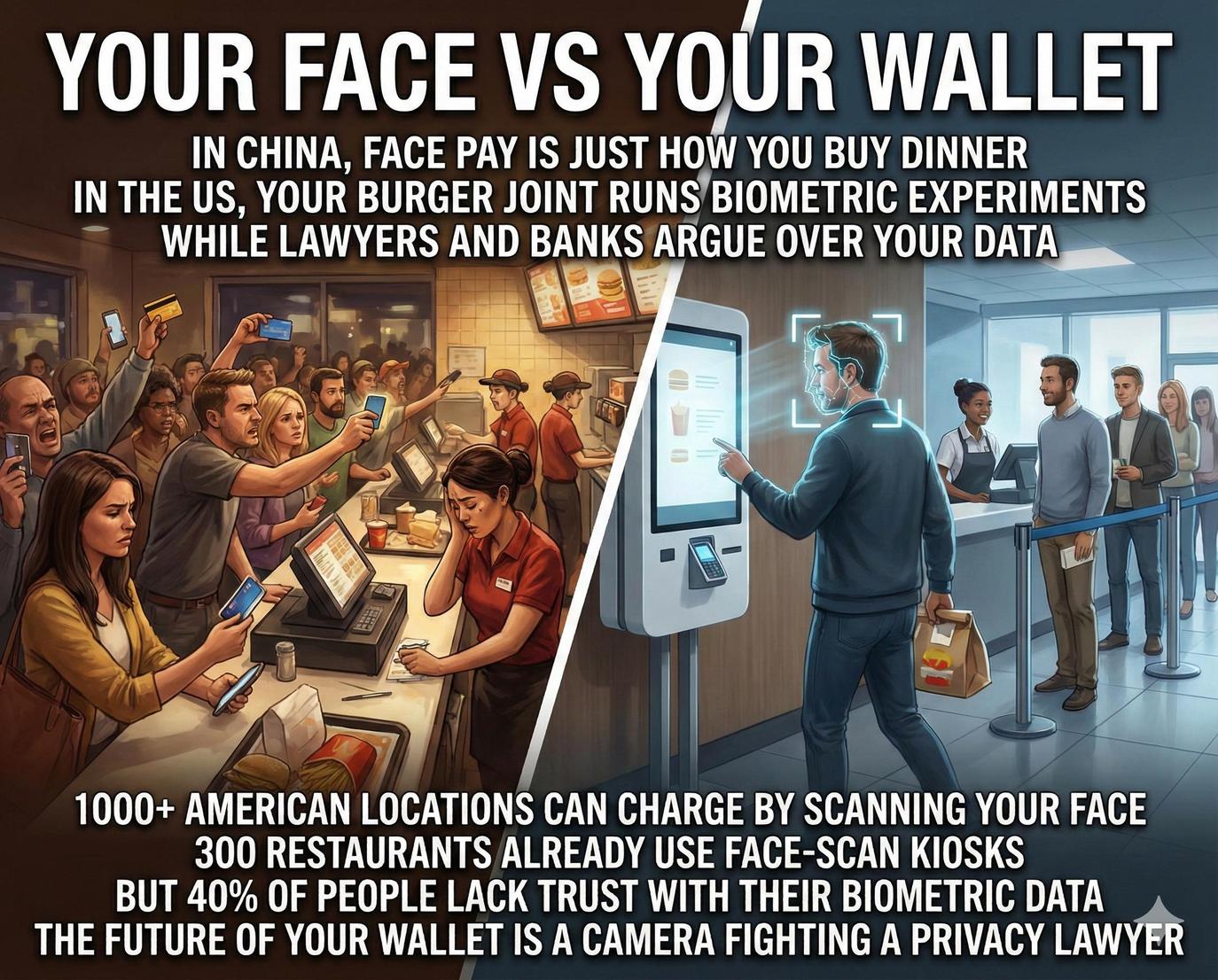

The era of paying with a glance has arrived, as biometric checkout systems finally secure a foothold in the American retail landscape. In recent years, the shift from physical cards to digital wallets has paved the way for “pay-by-face” solutions that promise a frictionless transaction experience. Facial recognition payments initiatives allow customers at participating quick-service restaurants to complete purchases through secure facial scans, reflecting a broader movement toward invisible commerce where the person, not the device, serves as the primary credential.

Major financial institutions and technology providers are working in concert to build a resilient foundation for these biometric payment rails. Companies like PopID and J.P. Morgan Payments are spearheading pilots that move beyond simple demos into high-volume commercial environments. These pay-by-face initiatives remain in the early stages, but the supporting payment infrastructure for a cashless society, from payment processors to terminal manufacturers, is growing rapidly.

Technological momentum in the United States is currently defined by a cautious, cluster-based deployment strategy. Rather than a nationwide sweep, these systems are appearing in specialized environments where customer loyalty and fast service are paramount. This selective adoption process allows brands to refine their identity verification templates and data privacy protocols while navigating a complex regulatory environment that prioritizes consumer protection and biometric accountability.

The Current Landscape of U.S. Biometric Payment Adoption

The momentum behind face-based payments is evidenced by several significant commercial milestones. These developments highlight a shift from experimental prototypes to real-world operational deployments:

- PopID has scaled to more than 1,000 U.S. merchant locations, with partnerships spanning restaurant chains, retail outlets, and entertainment venues, according to recent NEC and PopID reports.

- Steak ‘n Shake has implemented PopID systems for facial recognition checkouts across more than 300 restaurants nationwide, marking one of the first chainwide rollouts of biometric payments.

- Whataburger is piloting face-based payments at select Texas and Louisiana locations through an expansion supported by J.P. Morgan Payments.

- J.P. Morgan Payments and PopID have launched pilot programs for in-store biometric payments, including high-traffic environments such as the Miami Grand Prix, where all biometric transactions were reportedly processed in under one second.

- Verifone, a leading terminal manufacturer with over 45 million devices worldwide, is integrating biometric payment compatibility into its North American product line to support large-scale adoption.

These partnerships demonstrate the expanding footprint of biometric payments across diverse consumer sectors.

The “Pay-By-Face” Moment in America is Real but Narrower than it Sounds

The idea of paying with a smile is no longer confined to futuristic tech demos. In 2025, biometric checkout is being deployed in select U.S. quick-service chains and retail locations, signaling that real commercial adoption has begun. Yet for now, the rollout remains focused on controlled environments where customer flow is predictable and privacy concerns can be managed more easily.

U.S.-based PopID, a California company specializing in facial authentication for payments and loyalty programs, has emerged as the primary player driving this trend. PopID enables faster transactions by linking a customer’s facial profile to a preferred payment method while maintaining secure identity verification. In trials, the company reports that biometric checkout can reduce transaction times by up to 90 seconds and increase average order value by 4%, though these figures are vendor-reported and have yet to be validated by independent studies.

Despite impressive pilot results, face-based payments remain limited in scope. Privacy laws such as Illinois’s Biometric Information Privacy Act (BIPA) and local bans like Portland’s restriction on commercial use of facial recognition create a fragmented legal environment that discourages aggressive nationwide expansion.

Individual shoppers often express hesitation regarding the storage and protection of their biometric profiles. This reflects ongoing trust concerns that differ sharply from the high-adoption environment observed in China.

Operational Footprints: Where Biometric Checkout is Live

Today’s biometric checkout network in the United States is driven by a handful of key commercial partnerships. Steak ‘n Shake stands out as the first large-scale example, having integrated PopID’s facial recognition systems into kiosks across more than 300 locations. These kiosks allow customers to check in, confirm payment, and earn loyalty points automatically, creating a frictionless experience that aligns with fast-service models.

Whataburger is currently in the pilot phase, testing pay-by-face transactions at several Texas and Louisiana restaurants. The chain plans to evaluate customer acceptance before expanding the program more broadly. This partnership is supported by J.P. Morgan Payments, which provides the underlying financial processing for biometric transactions.

PopID technology has successfully expanded into a growing network of entertainment venues and college campuses. At the Miami Grand Prix, PopID-enabled systems reportedly processed 100% of biometric transactions in less than one second, showcasing the system’s scalability in fast-moving, high-volume settings. Beyond QSRs, early-stage deployments are also being explored in fitness centers, retail outlets, and drive-thru formats.

While these examples confirm that face pay has entered operational reality, the rollout remains localized. National expansion depends on broader terminal compatibility and consistent state-level regulations that clarify liability for biometric data handling.

The U.S. Stack: Identity Layer vs. Payment Rails vs. Terminal Distribution

The operational success of facial recognition payments depends on a specialized three-part infrastructure. This stack ensures that every transaction is secure, verified, and compatible with existing retail hardware:

Identity Layer

PopID serves as the identity bridge linking facial recognition with stored payment credentials. When customers opt in, their face is captured using secure computer vision templates that can be recognized at participating merchants. The process complies with privacy regulations by storing only abstracted data rather than raw images, allowing users to deactivate accounts or delete templates at any time.

Payment Rails

The involvement of major financial institutions marks a turning point. J.P. Morgan Payments is working closely with PopID to bring biometric transactions into mainstream payment networks. By embedding biometric authentication into the payment approval process that sits on top of card networks and gateways for digital transactions, the bank ensures compliance and trust, addressing one of the biggest barriers to adoption. Analysts view this as a critical evolution, transforming face pay from a novelty into a legitimate extension of the existing payments ecosystem.

Terminal Distribution

Finally, the hardware layer is being prepared for mass adoption. Verifone, one of the world’s largest terminal manufacturers, is now building PopID compatibility directly into its North American product line. With over 45 million devices in circulation and integrations across 150+ payment processors, Verifone’s move effectively opens the door for rapid scaling. Once these upgraded terminals are commonplace, merchants can activate biometric payment options without replacing their entire hardware fleet.

This integrated approach allows merchants to adopt biometric solutions without disrupting their core financial operations.

Global Pacing: Analyzing China’s Biometric Success Factors

China’s journey toward facial recognition payments began nearly a decade ago with Alipay’s ‘Smile to Pay’ launch in 2017. What started as an experiment quickly became a national norm, as face-pay adoption in China expanded from kiosks into grocery chains, transit systems, and neighborhood retailers.

The speed of this adoption stemmed from a powerful mix of cultural, economic, and technological alignment. Consumers were already accustomed to paying with QR codes through super apps like Alipay and WeChat Pay, which created a behavioral bridge to biometric payments. These major platforms successfully established unified ecosystems by 2020, integrating retail, transportation, and government services into a single user experience.

Chinese consumers also tend to express higher collective trust in major digital platforms compared with Western markets. Because the same companies handle everything from messaging to banking, users experience fewer brand transitions and less perceived friction in daily transactions. Government endorsement and rapid infrastructure rollout also accelerated normalization. The result was an adoption curve that rose sharply across urban areas, especially in cities like Hangzhou and Shenzhen, where facial recognition kiosks became ubiquitous in convenience stores and subways.

Even as China has begun refining its data protection rules, including new consent and opt-out regulations introduced in 2025, the scale of deployment is already entrenched. China’s unified approach contrasts sharply with the fragmented landscape found in the United States, where fragmented laws, individual opt-in standards, and litigation risk have slowed progress.

Domestic Hurdles: Regulatory and Privacy Challenges in the U.S.

The Impact of BIPA and Local Privacy Restrictions

The United States faces a unique challenge regarding the widespread deployment of identity verification templates: the hurdle of legal permission. American companies have the technology but not yet the universal green light to deploy it widely. Instead of centralized support, the U.S. landscape is shaped by a patchwork of state and local laws that regulate how facial data can be collected and stored.

Illinois’s Biometric Information Privacy Act (BIPA) remains the strictest, allowing individuals to sue companies for improper biometric use. Other states, including Texas and Washington, require consent and disclosure before any biometric capture. Cities such as Portland have gone further by banning private-sector use of facial recognition in public-facing businesses altogether.

Data Encryption and Public Trust

Legal exposure is only one part of the story, as consumer sentiment remains a defining hurdle. Recent surveys of U.S. users indicate that roughly 41 percent of respondents lack trust in corporate biometric management. Despite this skepticism, many users continue to interact with biometrics daily for basic device security and convenience. This widespread public caution has led major retailers to adopt a wait-and-see strategy, observing early pilots rather than committing to full-scale rollouts.

Even financial giants moving into the space, like J.P. Morgan Payments, are navigating the challenge carefully by emphasizing data minimization and encryption. The bank’s pilot programs show strong technical feasibility, but regulatory uncertainty makes full-scale rollout a slow, incremental process. Until national standards emerge, U.S. brands will continue to move cautiously, testing consumer reactions and compliance thresholds in isolated regions.

The International Play: U.S. Companies Building Abroad-Ready Infrastructure

While the U.S. domestic market develops cautiously, American technology providers are pursuing global expansion of facial recognition payments. Companies such as PopID and partners like NEC and Verifone are designing systems that can comply with international privacy frameworks, positioning themselves as global standards providers.

Strategic Global Standards and Hardware Integration

NEC’s 2025 investment in PopID underscored this international ambition. The partnership aims to make PopID’s face-pay technology compatible with millions of terminals across Asia, Europe, and North America. Likewise, Verifone’s integration of biometric payment capabilities into its terminal hardware creates a hardware foundation that can be activated anywhere compliance allows.

This “build once, deploy globally” approach enables American firms to demonstrate performance abroad, refine data handling procedures, and eventually return with compliance models that fit the U.S. regulatory environment.

So… Does the U.S. Follow China’s Curve—or Stall at Niche Use Cases?

The U.S. trajectory could unfold in several directions. One scenario mirrors China’s, with biometric checkout evolving from niche pilots into mainstream commerce once public trust and unified regulation take hold. Another scenario keeps face pay confined to opt-in loyalty programs and closed-loop environments such as QSRs, gyms, and event venues, where customers actively choose convenience.

Transparency and Data Choice

A third and increasingly likely path is hybrid adoption, where biometric authentication supplements rather than replaces card-based transactions. Consumers might use their face- or hand-based biometric checkout systems for loyalty and check-in but still confirm payment through a card or digital wallet. This model satisfies privacy expectations while offering the speed benefits of biometrics.

The success of biometric payments hinges on transparency, reliability, and consistent governance. U.S. consumers are not opposed to biometric technology; they simply demand clearer boundaries. If those conditions are met, face pay could expand far beyond fast food and entertainment venues into mainstream retail by the late 2020s.

Navigating the Future of Seamless Biometric Commerce in America

Advancements in biometric technology have moved the ‘pay-by-face’ concept from a niche experiment into a viable operational reality for hundreds of U.S. merchants. The readiness of the underlying stack—encompassing identity layers, payment gateways, and terminal hardware—ensures that the technical barriers to entry are rapidly dissolving.

For these systems to transition from specialized QSR pilots to a standard feature of the American retail experience, the industry must prioritize transparent data handling and robust security frameworks that reassure a cautious public.

Sustainable growth in this sector relies on a delicate balance between frictionless convenience and ethical accountability. Industry shifts in the coming years will decide whether these technologies serve merely as supplemental loyalty tools or if they will fundamentally redefine how we verify our identities and exchange value in a digitally native economy.

Common Questions Regarding Biometric Transactions

Where can I use facial recognition payments in the U.S.?

You can find active systems at Steak ‘n Shake and select Whataburger locations, which are currently spearheading the nationwide rollout.

Is paying with your face secure?

Encrypted templates protect your identity by storing abstracted data points rather than actual images of your face.

How do U.S. biometric laws affect these systems?

Fragmented state regulations like BIPA require strict user consent and transparency before any biometric data collection occurs.

Can I use facial recognition instead of a credit card?

Current systems act as a secure authentication layer linked to your existing financial accounts for faster checkout.

What makes the U.S. rollout different from the system in China?

American deployment relies on private innovation and individual opt-ins rather than top-down, unified mobile ecosystem adoption.

link