Samsung SDI eyes robotics market with all-solid-state batteries

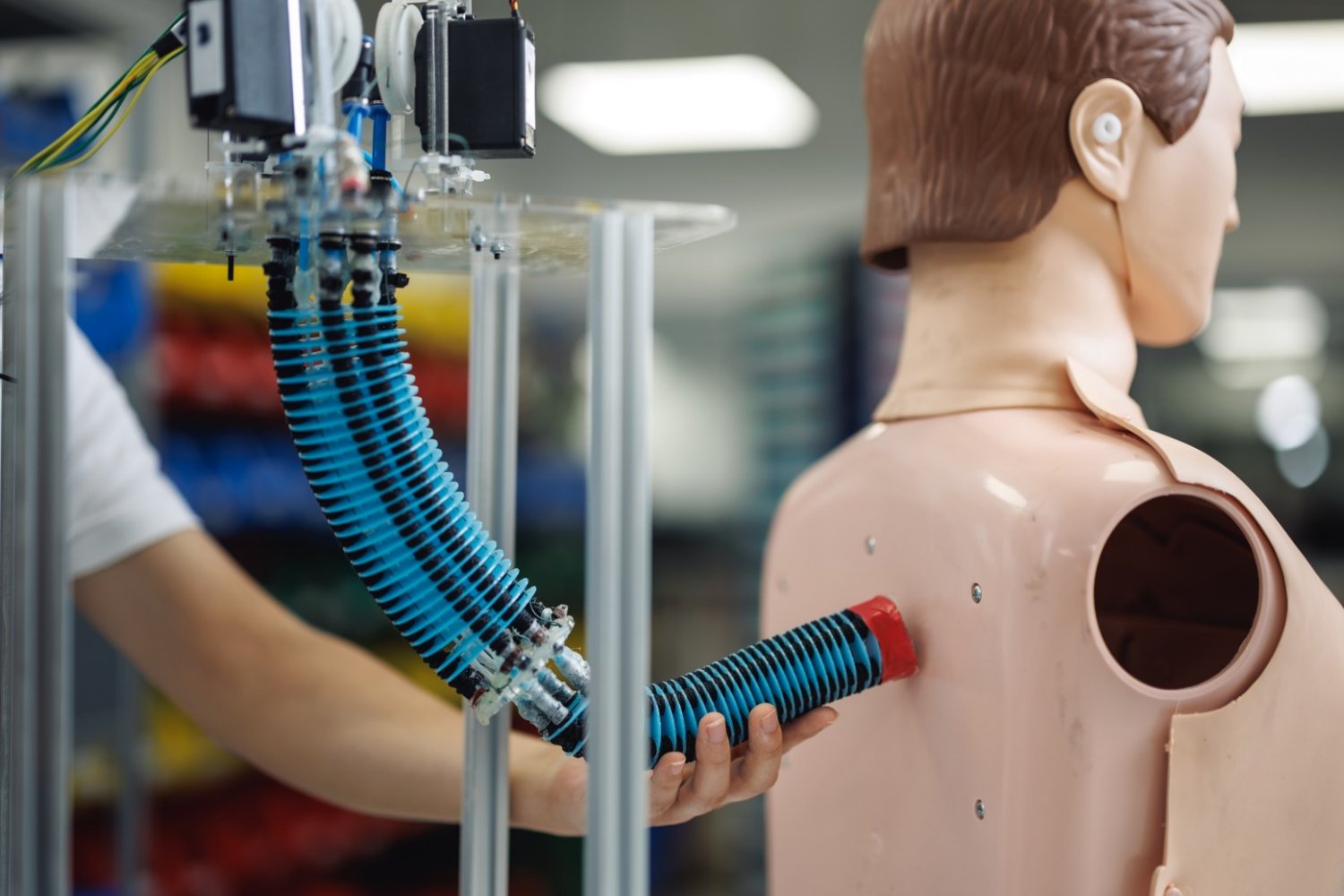

The prototype of Samsung SDI’s all-solid-state battery / Courtesy of Samsung SDI

Samsung SDI said Monday that it has been seeking collaboration with multiple robotics companies looking to use its all-solid-state batteries, which are under development and set for mass production starting next year.

The statement fueled speculation that Samsung SDI’s all-solid-state batteries could be used to power Hyundai Motor’s Atlas humanoid robot, given the partnership between the battery manufacturer and the carmaker.

“Thanks to the application of physical artificial intelligence technology, the robotics market has grown rapidly and demand for all-solid-state batteries is increasing, considering the limited space for batteries in such devices and the need for high safety and power,” Park Jong-sun, head of Samsung SDI’s battery strategic marketing office, said at a conference call on the company’s earnings during the fourth quarter of last year.

Samsung SDI’s quarterly operating loss from its battery business reached 338.5 billion won ($231 million). Despite the disappointing results, the company expressed confidence in a turnaround this year, citing its preparation to capitalize on future technologies.

“The company has continued to enhance its future technology capabilities by signing a memorandum of understanding with Hyundai Motor and Kia to jointly develop batteries dedicated to robotic applications,” Samsung SDI said in a press release. “The small battery market is expected to rebound in demand, with growth anticipated in emerging areas such as robotics.”

Securities analysts already consider Samsung SDI the leading candidate to supply batteries for Atlas, given its track record of providing batteries for Hyundai Motor’s other robots and its ongoing development of all-solid-state batteries.

Its stock price soared after last month’s CES 2026 in Las Vegas, where Hyundai Motor unveiled the humanoid robot, which was developed by its U.S. subsidiary Boston Dynamics.

“The potential partnership between Samsung SDI and Hyundai Motor for Atlas’ battery has drawn significant attention,” DB Securities analyst Ahn Hoe-soo said. “There could be a meaningful application of Samsung SDI’s all-solid-state batteries in the robotics industry before they are used in the electric vehicle (EV) sector.”

LG Energy Solution (LGES) and SK On are also looking for new business opportunities in the robotics market, as they have fallen behind their Chinese competitors in the EV market, which shows strong demand for the more affordable and fire-resistant lithium iron phosphate batteries.

Leveraging their expertise in ternary batteries, Korean firms are targeting robotics companies that require products with higher energy densities.

Known as a battery supplier for Tesla’s Optimus robot, LGES said during its earnings call Thursday that it supplies cylindrical batteries to six major robotics firms in Korea, the U.S. and China.

“We have secured orders from most industry leaders, including those producing four-legged robots, not just humanoids,” Lee Yeon-hee, head of LGES’ corporate strategy, said after the company reported an operating loss of 122 billion won in the fourth quarter of last year.

Lee added that the company plans to commercialize anode-less all-solid-state batteries for humanoid robots by 2030.

SK On said during its earnings call Wednesday that recent news about its battery supply for Hyundai WIA’s logistics and parking robots at Hyundai Motor Group Metaplant America demonstrates its consistent efforts to diversify its business portfolio.

“We are stepping up efforts to explore new markets for various battery applications, including humanoids,” Kim Young-kwang, head of SK On’s financial management office, said after SK On’s parent company, SK Innovation, announced a fourth-quarter operating loss of 441.4 billion won from its battery business.

link